Participants in and beneficiaries of tax- qualified retirement plans are not required to report a foreign financial account held by or on behalf of the retirement plan. Owners and beneficiaries of IRAs do not have to report foreign financial accounts held in an IRA. Foreign financial accounts owned by an international financial institution (if the U.S. Foreign financial accounts owned by a U.S. Correspondent/nostro accounts (bank accounts established by banks solely for bank- to- bank settlements). persons that are entities included in a consolidated FBAR filed by a greater- than- 50% owner The spouse of an individual who files an FBAR is not required to file a separate FBAR if (1) all the financial accounts that the nonfiling spouse is required to report are jointly owned with the filing spouse (2) the filing spouse reports the jointly owned accounts on a timely filed, electronically signed FBAR and (3) the filers have completed and signed Form 114a, Record of Authorization to Electronically File FBARs (see discussion below). person owns (directly or indirectly) more than 50% of the voting power, total value of equity or assets, or profits interest.Ĭertain U.S persons or foreign financial accounts are excluded from the FBAR reporting requirements. person has a greater than 50% direct or indirect present beneficial interest in the trust's assets or receives 50% of the trust's income

A trust, foreign or domestic, in which the U.S.person is the grantor and has an ownership interest in the trust for U.S. person owns (directly or indirectly) an interest in more than 50% of the partnership's profits or capital A partnership, foreign or domestic, in which the U.S.

person owns (directly or indirectly) more than 50% of the total value or more than 50% of the voting power of all shares of stock A corporation, foreign or domestic, in which the U.S.person with respect to the account, including agents, nominees, and attorneys person also has a financial interest where the owner of record or holder of legal title of the account is any of the following: person is the owner of record or has legal title, whether the account is maintained for his or her own benefit or the benefit of others, including non- U.S. person has a financial interest in an account for which the U.S. If a child cannot file his or her own FBAR, a parent or guardian must file for him or her.Ī person with "signature authority" is a person who can control the disbursement of money or other property in the account using his or her signature.Ī person with "other authority over an account" is a person who can exercise power over an account by communicating directly, orally or otherwise, to the financial institution or other person maintaining the account.Ī U.S. A child who falls under the FBAR filing criteria is not exempt from filing. residents entities, including but not limited to, corporations, partnerships, or limited liability companies, created or organized in the United States or under the laws of the United States and trusts or estates formed under the laws of the United States.

The aggregate value of all foreign financial accounts exceeded $10,000 at any time during a calendar year.įor these purposes, U.S.

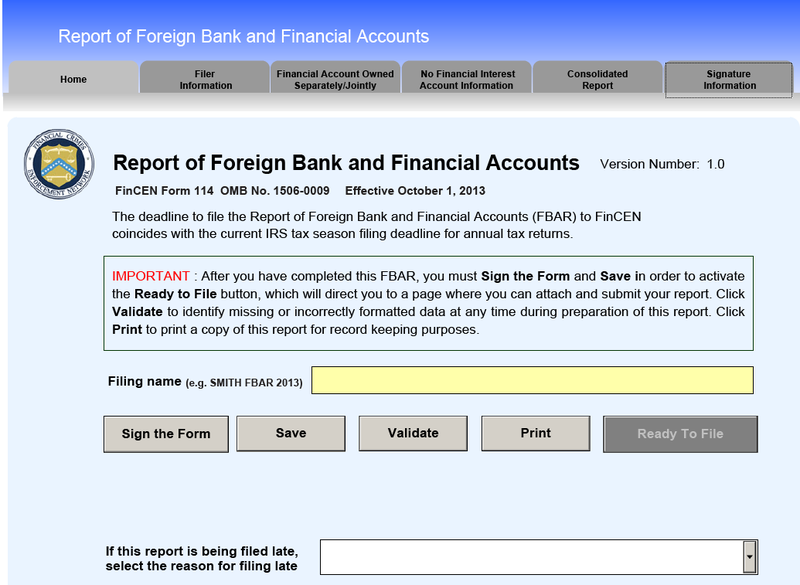

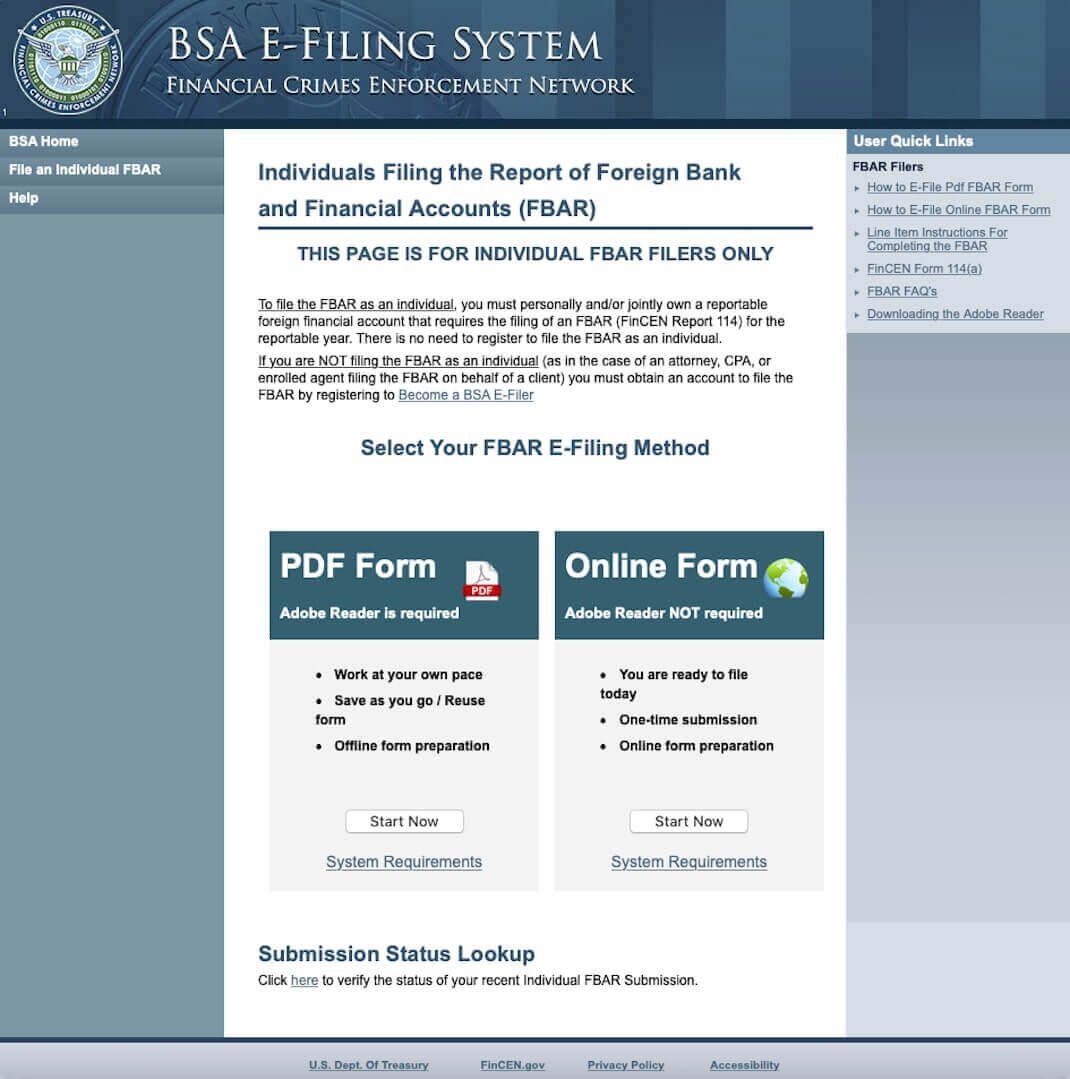

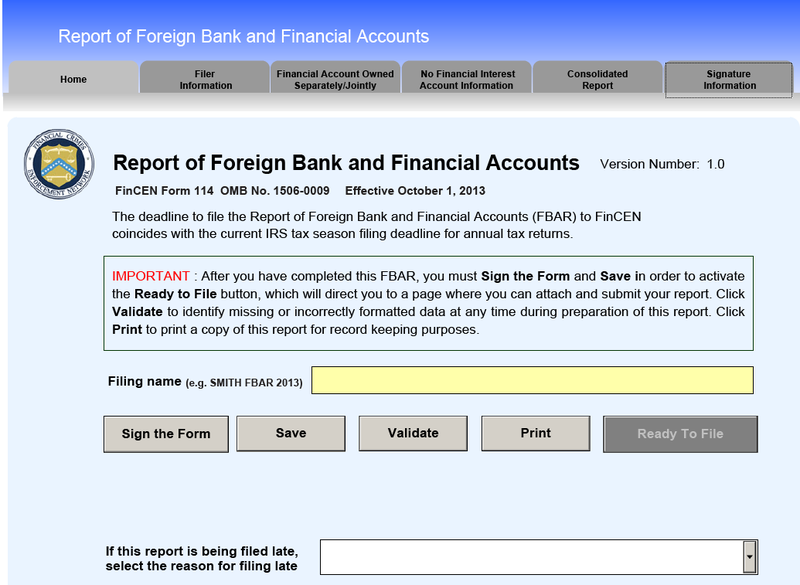

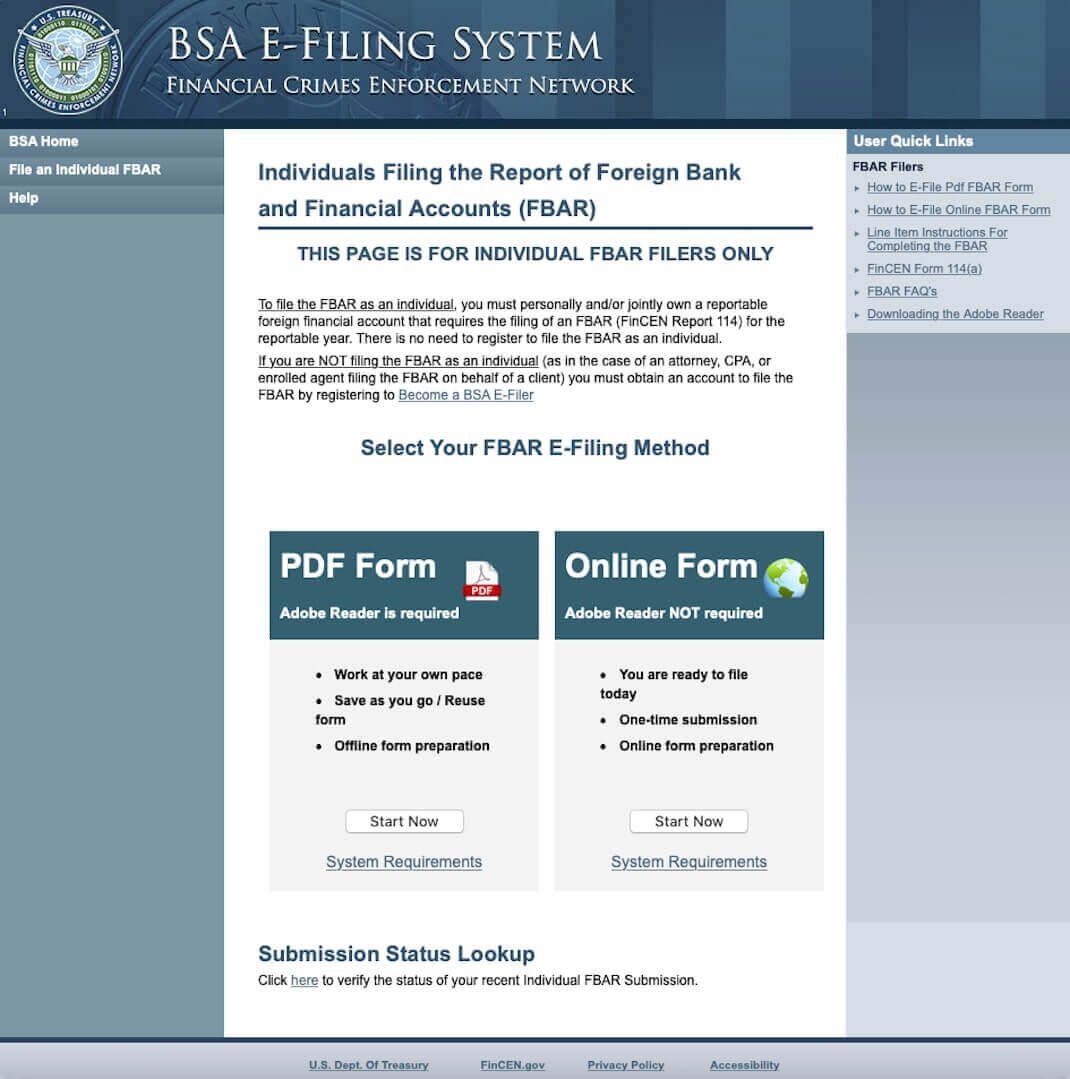

The person had a financial interest in or signature authority over (or any other authority over) at least one financial account located outside of the United States and. taxpayers, the IRS has implemented streamlined filing compliance procedures to help those who have unreported foreign financial accounts to come into compliance.Ī U.S. It was designed, along with other reporting requirements such as FATCA, to deter tax evasion.Īs discussed below, to assist U.S. FATCA requires filing Form 8938, Statement of Specified Foreign Financial Assets, with the federal income tax return, a separate requirement from the FBAR filing.įBAR is not a tax return (and it isn't filed with the IRS, unlike Form 8938)-it is an information report. Individuals who are required to file FBARs need expert advice to ensure proper compliance not only with the FBAR filing requirements, but possibly with other reporting requirements such as the Foreign Account Tax Compliance Act (FATCA), P.L. Financial accounts that must be reported include bank accounts, brokerage accounts, mutual funds, trusts, or other types of foreign financial accounts with balances that exceed certain thresholds. persons who have a financial interest in or signature authority over a foreign financial account to report the account annually to the Department of Treasury by electronically filing Financial Crimes Enforcement Network (FinCEN) Form 114, Report of Foreign Bank and Financial Accounts (commonly called FBAR), through FinCEN's BSA E- Filing System.

The person had a financial interest in or signature authority over (or any other authority over) at least one financial account located outside of the United States and. taxpayers, the IRS has implemented streamlined filing compliance procedures to help those who have unreported foreign financial accounts to come into compliance.Ī U.S. It was designed, along with other reporting requirements such as FATCA, to deter tax evasion.Īs discussed below, to assist U.S. FATCA requires filing Form 8938, Statement of Specified Foreign Financial Assets, with the federal income tax return, a separate requirement from the FBAR filing.įBAR is not a tax return (and it isn't filed with the IRS, unlike Form 8938)-it is an information report. Individuals who are required to file FBARs need expert advice to ensure proper compliance not only with the FBAR filing requirements, but possibly with other reporting requirements such as the Foreign Account Tax Compliance Act (FATCA), P.L. Financial accounts that must be reported include bank accounts, brokerage accounts, mutual funds, trusts, or other types of foreign financial accounts with balances that exceed certain thresholds. persons who have a financial interest in or signature authority over a foreign financial account to report the account annually to the Department of Treasury by electronically filing Financial Crimes Enforcement Network (FinCEN) Form 114, Report of Foreign Bank and Financial Accounts (commonly called FBAR), through FinCEN's BSA E- Filing System.

0 kommentar(er)

0 kommentar(er)